The complete guide to Demand Response Software

Before we get into the technical details of demand response software, let's take one step back to assess the need for this type of technology.

Our sustainable energy future depends on full electrification and renewable energy supply. Electrification leads to a large increase in the demand for electricity as electric vehicles take over the roads and heat pumps are installed in every new home. The new energy supply from wind and solar on the other hand is highly intermittent, making it more difficult to deliver consistently on the energy peaks produced by electrification.

Luckily demand response (DR) is here to help balance supply and demand, making it possible to transition to a zero-carbon energy system with less need for infrastructure investments.

As an energy or utility company, demand response is one of the key areas you need to understand and capture value from. Especially in the midst of the green revolution we are part of now. With this opportunity comes the need for demand response software that can deliver on your use case and scale with the organization and your energy assets.

In this guide, we will give you a full overview of the demand response software landscape, from what it is to how you can benefit from it and what to look for in a provider.

More specifically we will cover:

- What is Demand Response Software

- The best Demand Response Software providers

- How to evaluate Demand Response Software providers

- The next step on your demand response software journey

What is Demand Response Software

Demand response (DR) software connects to your energy assets and make them available for trading in relevant flexibility markets. Some DR software also includes aggregation of distributed energy resources (DERs) like electric vehicles, thermostats, HVAC units and batteries. The main objective is to utilize energy hardware to balance the grid during peaks.

Demand response software comes in different shapes and sizes, some covering the entire tech stack to others specializing in one area. Common for all of them is the objective of connecting your energy assets to the local or national demand response market. This includes connecting to and controlling hardware, aggregation and forecasting, as well as trading and reporting.

Many energy companies and utilities are themselves responsible for parts of this tech stack, making it better to get a more specialized solution in place for the missing parts. An example of this is a pure Virtual Power Plant Software provider that can fill a hole in an internal DR setup. Others, who might be less familiar with demand response, are looking for a more holistic demand response software covering the entire process. This can also include consulting services for implementation and scaling, where you as a customer only see the result of the demand response solution built for your energy hardware.

The objective: a more stable grid

Common for all demand response software is the goal of building a more resilient grid. This entails both frequency and traditional peak load flexibility markets. In some cases, the software will also trade based on price signals from the energy supply. This can lead to more renewable energy in the grid, which in many cases is cheaper than non-renewable.

The full demand response software stack

Demand response software can in general be split into three different parts.

1 — Energy hardware connection and control

All demand response software needs to be able to connect to and control a broad range of energy hardware, whether that be ACs, thermostats, heat pumps, EVs, or other energy assets.

For many C&I implementations, this involves a hardware device installed on-premise. This makes sense as the load is large enough to recoup the investment. In residential use cases, it is now possible to connect via a cloud-to-cloud for most DERs, like EVs and thermostats. This makes it easy to scale DR programs to a large set of consumers without any need for propriety devices installed in the house.

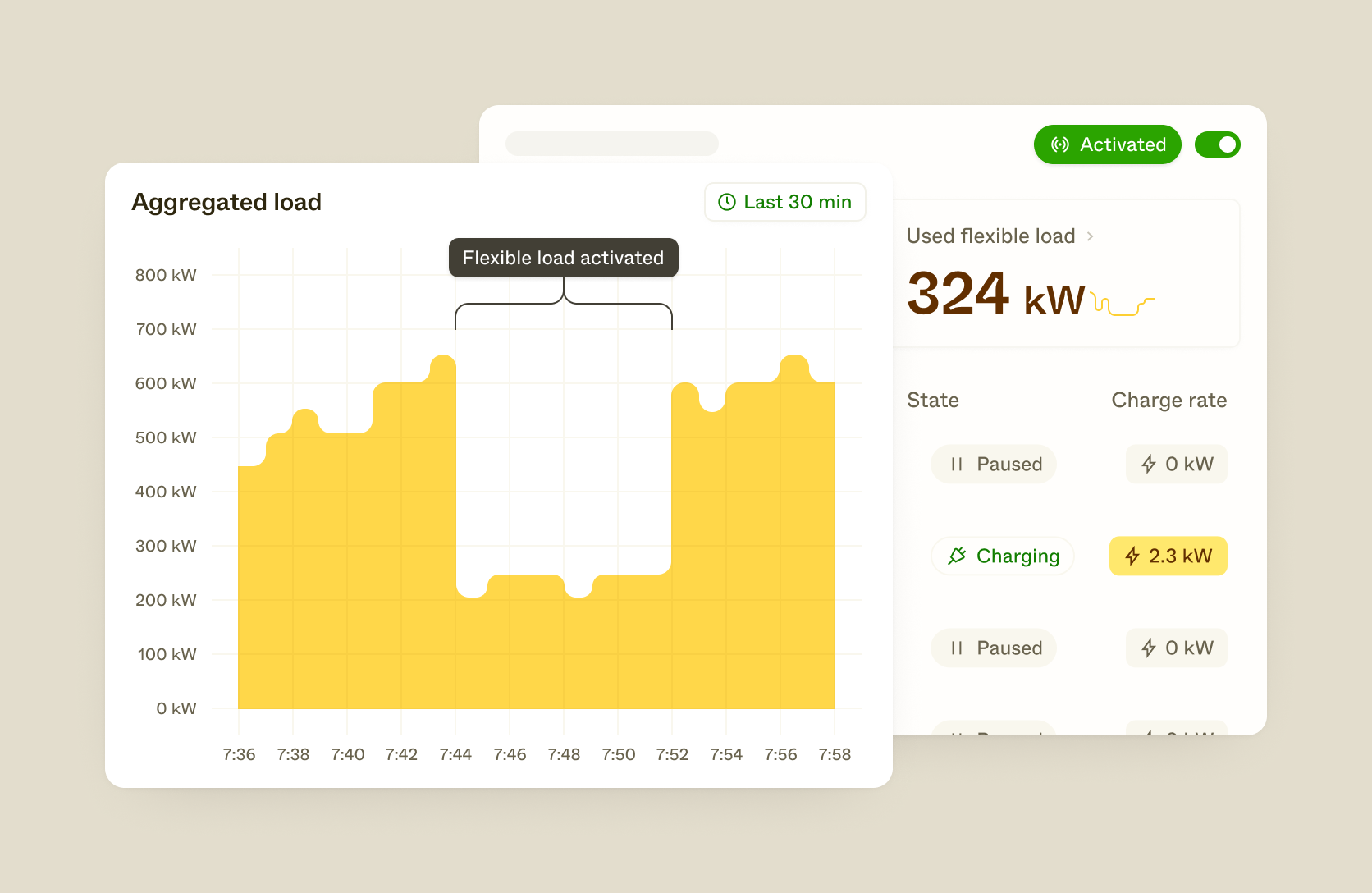

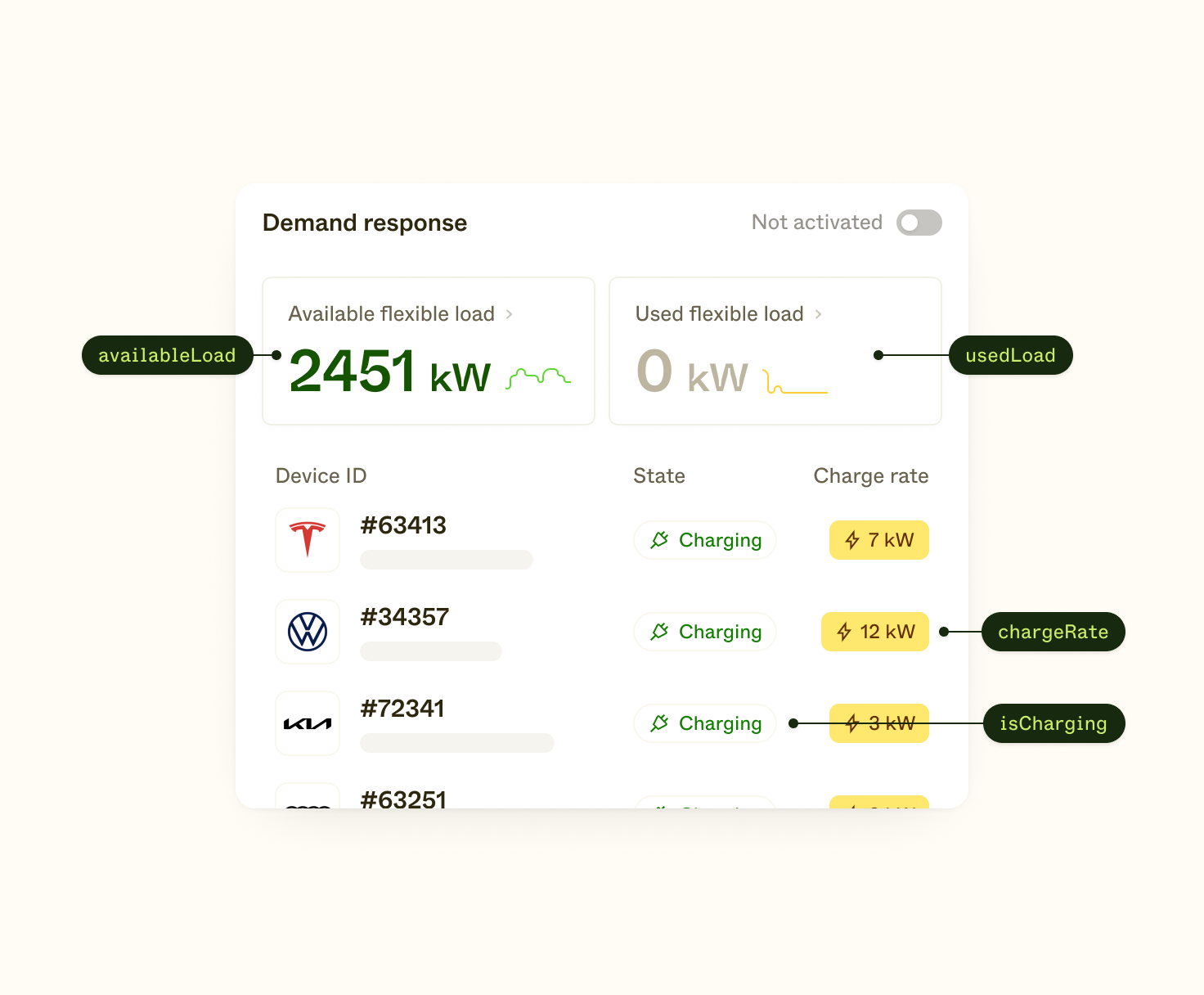

2 — Aggregation and Virtual Power Plant (VPP) generation

Once you have your energy assets under control, the next thing the demand response software needs to handle is aggregating them to increase the value. One C&I asset or one residential EV is not enough to really create value from demand response. The real value comes from creating a large Virtual Power Plant (VPP) that can operate as one entity.

This also entails analyzing and determining the total available capacity for your VPP, that can be made available in the flexibility market. This will most likely fluctuate heavily thought the day and for different geographical areas, so a lot of demand response software also relies on specialized VPP software to handle this part of the tech stack.

3 — Market connection, trading, and reporting

When steps 1 and 2 are complete you are ready to integrate into the local flexibility market. This is handled by a broad spectrum of DR software providers today. Flexibility markets vary from country to country, and for the US from state to state, so it is important that you choose a vendor with support for your local market.

This part of the demand response software is as mentioned responsible for connecting to the flexibility market and conducting trades based on your available flexibility and the price signals from the exchange. All this is done automatically by the DR software. After the demand response event, the software will also report the load that was contributed and calculate the revenue generated.

Access to Distributed Energy Resources (DERs)

One question we often hear is where most energy companies and utilities find Distributed Energy Resources to bundle as VPPs. For the residential space, in our experience, the most viable way forward is to create a consumer-facing app that lets the user connect their own DERs to your demand response software. This can be done via EV APIs, Solar Inverter APIs, Heat Pumps APIs, Thermostat APIs, EVSE APIs and more.

The best Demand Response Software providers

So now that we have covered what the demand response software is, let's turn our attention to the different providers out there. In this case, we have focused mainly on the US, as this market is mature when it comes to DR.

Enel X

Enel X is one of the most experienced players in the demand response market. They cover C&I and residential use cases, and with the launch of Enel X Way there is also a huge push for smart charging. If you are looking to run your own DR program or want to participate in one as an energy hardware owner, Enel X is a company to talk to.

You can read more about their offerings here.

Oracle

When Oracle bought Opower they quickly secured a key position in the US utility and demand response software market. Focused on utilities that want to engage end-users with DR, Oracle has a full suite of offerings as part of their demand response software. From what we have read they are not as experienced in EV DR as Enel X, but still have broad coverage of DERs in their supported list.

You can read more about their offerings here.

Eaton

Eaton is a legacy provider in the demand response software space, but still draws in a lot of new customers based on their proven track record. They focus on thermostats as their main DER category and have delivered more flexibility than any other DR software provider to date.

You can read more about their offerings here.

Enode + Leap / Voltus

Having worked on connections to DERs for several years now, we at Enode have entered into the demand response software market with a more specialized product. Our aggregate product functions as a Virtual Power Plant (VPP), making it easy to combine our solution with companies like Leap or Voltus for DR market connection.

You can read more about our VPP product here, and Leap and Voltus by following the links.

How to evaluate Demand Response Software providers

Before you move forward with one or more of the suppliers in the list, we have some general recommendations that we have seen save companies some headaches in this situation before.

Holistic or specialized

Based on the energy asset you have available and the knowledge and expertise your team possesses, it is good to assess whether you want to procure a holistic demand response software solution or build something more custom with specialized tools.

If you have a standard energy asset that can be plugged into many DR software providers and also a strong tech team that can handle system integrations themselves, a more specialized tool might make sense. On the other hand, if you have a non-standard energy asset and little knowledge about the DR market, it would make sense to let an experienced provider take care of the entire DR journey.

C&I or Residential

The next consideration to make is whether you want software that focuses on C&I vs residential DERs. Many of the DR software providers have specialized in one direction for 5-10 years, making them excel in one category over another. Others also consider themselves more of a DERMS provider than DR software provider. Here the line is blurry, so talk to all providers before making a choice.

Price and revenue share

This is the obvious one. Price can vary a lot between the vendors, and the same goes for the revenue share they offer for different markets. One extra thing to consider is what amount of support is included in the offering. Some demand response software providers are just that, software providers, with little extra hands-on support. Others are closer to consultancies, with integrations projects and continuous support along the way. You know what works best for you.

The next step on your demand response software journey

Most companies we interact with, from large utility companies to smaller energy startups, begin this process by talking to several of the DR players in the industry. This is a good way to learn and assess what providers have the capability to deliver on your need.

If you want to learn more about demand response and what opportunities we are seeing, we have gathered some useful resources:

- A full guide to demand response

- A full guide to VPP software

- IEA demand response report